In New Jersey, after a mortgage lender has obtained a final judgment in foreclosure, they can schedule a Sheriff Sale of the property. If you are facing this situation, it is important to know that it will not happen immediately because a specific process must be followed.

The County Sheriff where the property is located is responsible for conducting the sale. Each County Sheriff’s department has a different schedule for when the sheriff sale is held in their county as well as slightly different procedures. Most of the County Sheriff’s departments have a list of properties to be sold at auction on their website. Additionally, paper lists can be reviewed at all Sheriff’s Departments during normal business hours.

How Will I Get Notice of the Sheriff Sale?

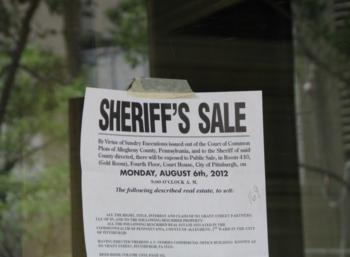

Many people tell us they are afraid that they will not get any notice of the sale -and that they will come home and their house will be padlocked. Please know that the sale will not happen without notice. Sheriff sales are required to be announced by a Sheriff in the following ways:

- A notice of the Sale will be published in 2 newspapers in the County

in which the real estate is located for 4 consecutive weeks prior to the initial date of the sale. The first publication must be at least 21 days before the sale and the last must be at least one day and not more than 8 days before the sale. - Another notice will be posted in the Sheriff’s office in the County

where the property is located at least 3 weeks prior to the sale and - A third notice will be posted on the property itself subject to some

exceptions and - At least 10 days before the sale the mortgage company must serve a

notice of the sale by certified or registered mail, return receipt requested on the property owner.

What is the Sheriff Sale Process?

How does a sheriff sale work in NJ? Sheriff sales in New Jersey are subject to liens, be it Federal, State, or local. So, a title search is run before the Sheriff sale process in New Jersey or the bidding process to check for outstanding liens. Bidders need to have the information in the title report as successful bidders naturally assume responsibility to pay for the liens.

Sheriff Sale Auction

After the required notice is given, the Sheriff sale process in New Jersey begins at the time and place set forth in the notice. The sale generally takes place at the Office of the Sheriff. The Sheriff Sale uses voice bidding instead of sealed bids. As explained earlier, the sale is subject to any mortgages and municipal, state or federal liens on the property.

The sheriff sale auction begins as the bank’s attorney initiates the bidding process with a hundred dollar bid. Then the bidding process continues until the highest bidder is finalized. If the successful bidder is anyone other than the plaintiff/creditor’s counsel, the counsel can keep bidding until the amount owed on the first mortgage plus fees and costs, is reached. At this point since the creditor’s interests are protected thanks to the third party bid which exceeds the amount owed, the counsel typically stops bidding.

Finalization of Sheriff’s Sale

To conclude the Sheriff sale process in New Jersey, a successful bidder is determined. They need to pay a deposit amount of 20% of the successful bid to conclude the sale. Once the sale is concluded, a 10 day redemption period begins in which the former owner can either redeem the property by paying the amount related to the judgment plus other liens and costs, if applicable or try to object to the sale. After the redemption period, if the former owner has neither redeemed nor successfully objected to the sale, the sheriff’s sale deed is prepared. Finally the balance owed with regards to the closing bid is to be paid on or before the thirtieth day (30 days) from the date of the sale deed.

After the sale, the buyer must get a warrant for the homeowner’s removal. How long it takes depends on the particular county, but it can take approximately 4-6 weeks or more. The homeowner has the right to file a motion to ask the judge for more time before they must leave.

Can the Sheriff Sale Be Delayed?

The Sheriff Sale can be delayed in ways including the following:

- A Homeowner is Entitled to Two Adjournments

A homeowner is entitled to two adjournments of the Sheriff Sale. As of July 29, 2019, each adjournment of the Sheriff Sale is for 30 days. (It used to be 14 days). Also, as of July 29, 2019 there is a 5-adjournment limit for the Sheriff Sale (twice at the lender’s request, twice at the homeowner’s request and once if both the lender and the homeowner agree to an adjournment.) To obtain these stays of the sale you must go to the county sheriff in person before the sale takes place. You must pay a fee by cash or money order. Contact the Sheriff’s office in your county to find out the amount of the fee. You do not have to prove good cause or appear before a judge to obtain these adjournments. After using your 2 adjournments a homeowner can file a motion with the court to ask that the sale be stayed.

- Filing Bankruptcy Can Delay the Sheriff Sale

At any point in the foreclosure process, up to the date of the Sheriff’s Sale, you can file a Chapter 13 bankruptcy which puts into place an “automatic” stay which halts the Sheriff Sale and other actions by the Creditors.

- Submitting a Complete Loan Modification

If a complete loan modification application is submitted at least 37 days prior to the Sheriff Sale, the lender must adjourn the sale and review the application.

Your Right to Redeem the Property

Once your property is sold at Sheriff Sale, you have 10 days to redeem (get back) the property. This 10-day period allows a homeowner to arrange to keep the property by refinancing or selling it and paying what in full what is owed plus costs. If you do not redeem the property within 10 days, the proceeds from the sale are paid to the mortgage lender, and any other lienholders, with any excess paid to the homeowner. If the house sells for less than the mortgage balance, which is often the case, the lender may have the right to sue the homeowner for the deficiency, although this is rarely done.

Contact Us Today

If you are facing a Sheriff Sale in New Jersey, or have questions about how to save your home from foreclosure let the attorneys of Levitt and Slafkes, PC help. We help individuals save their homes through loan modification, bankruptcy and foreclosure defense. Contact our law firm online or by calling 973-323-2953 to schedule a free consultation.

We are proudly designated as a debt relief agency by an Act of Congress. We have proudly assisted consumers in filing for Bankruptcy Relief for over 30 years. The information on this website and blogs is for general information purposes only. Nothing should be taken as legal advice for any individual case or situation.